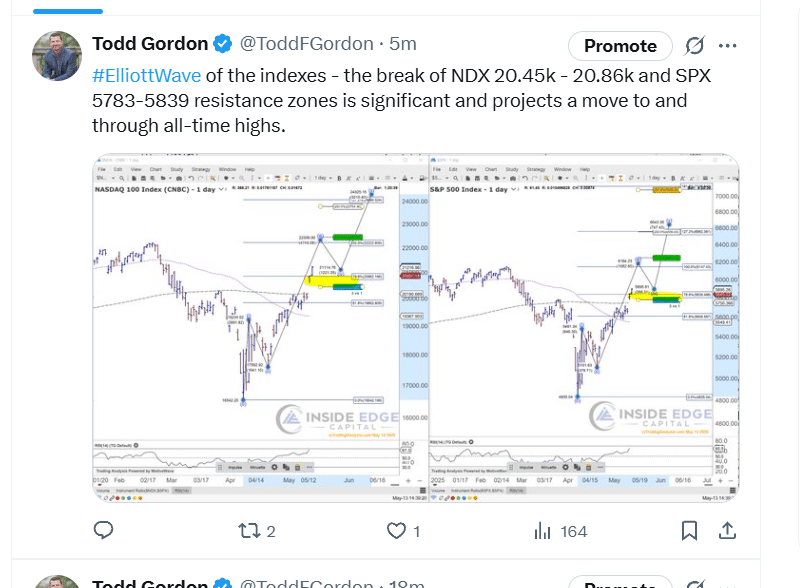

April showers bring May flowers! This also applies to the markets with an April selloff followed by an equally strong May recovery – a “V” bottom?! We’re having a big day here as more positive trade deal news hits the wire along with April CPI reports below expectations. We’re above key resistance zones that points to new all-time highs as I tweeted (X’d ??) this afternoon:

I give this market so much credit. With the softer CPI, we’re still only at a 37% chance of a July cut as FF futures keep pushing out the cuts, and the market is ok with it. As I’ve been saying for months, a 4 1/4 fed funds rate is probably where rates should be, considering the underlying health of this economy. If most investors could set aside their political biases, fortifying the confirmation bias from the constant barrage of traditional and social media messaging that tariffs are the sole driver of this market. Tariffs and politics are actually quite a small piece in the big picture, but they’re such catchy headline grabbers that increase the divisiveness. Remember, if it bleeds, it reads.

We’re in an AI revolution within the technological evolution in an economy that is focused on fiscal responsibility, embracing the deflationary forces of technology. Did you see Microsoft cutting headcount by 3%? Companies and our country are embracing the increased operating efficiencies of technology to increase margins. Look at our Palantir position. Now, if I could just find the best use of AI technology to help my U11 travel baseball team to get their throws, catches, and swings in line….sigh. Anyway, we could see new market highs soon.

Speaking of defense, Trump announced a deal with Saudi Arabia of a $600bn investment into the US in exchange for $142bn in weapons for the Saudis, double their annual defense budget. I’m sure Trump is trying to deter Iran and Russia from additional offenses while bringing additional investment in the US AI buildout.

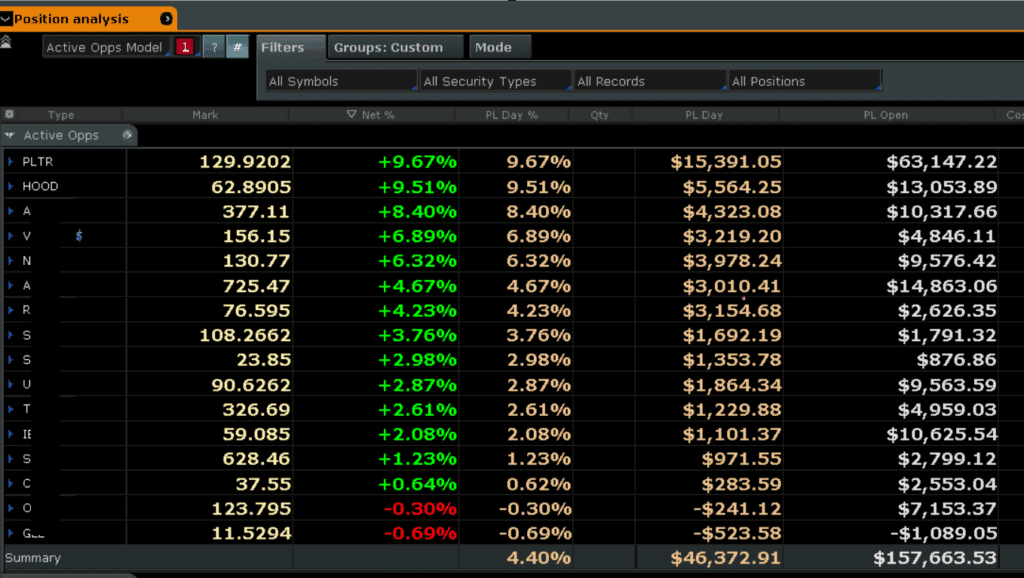

Anyway, the portfolio is looking solid and having another very green day (screenshot attached), but with one little tripwire that I don’t feel comfortable with in here; 30.87% cash.

But, as I mentioned, those Fib retracements and daily moving average resistance zones were worrisome for me. But it looks like momentum carried us up and away, suggesting the V-bottom is in place and we’re headed to new highs. Remember that anything can happen on any day, nobody can see the future, and our job is to focus our energy on thoroughly assessing the now. Wasting energy predicting what should happen tomorrow usually just serves as an overly inflated view of our IQ, while at the same time showing low EQ. Watching closely and having a lot of fun here!

-Todd

P.S. – I KNOW I’m not a good writer, and for that I apologize. I ran it through Chat GPT to clean up grammar and sentence structure, but it just looses to much of my original voice so I wanted to keep it as is. Thanks for using Savvy Trader – for me, so far, I love it. It solves SO many issues we had running day-to-day operations at TradingAnalysis and it helps the transition over to Inside Edge Capital. Speaking of, we have a new website up – www.InsideEdgeCapital.com There are still a few things to clean up, but go check it out.

Or, if you want real-time updates on the Active Opps portfolio, click here: