Investment Management

Active Management

1 . Active Management

We employ an active, tactical, and opportunistic approach to investment management that adapts to prevailing market conditions offering our clients peace of mind. We choose to work with clients who believe the traditional approach of ‘buy the averages, hold, and hope…’ is for well – the average masses. Our clients demand more than just ‘average’ performance and passive management of their portfolios. In the last 23 years we’ve been through 3 significant market declines that were incredibly unnerving, especially to investors in their retirement years. These boom and bust cycles create challenges, dangerous pitfalls, but also opportunities in today’s increasingly complex economy. We feel our client’s nest egg built over a long career is too valuable to risk leaving in the hands of money managers who are asleep at the wheel, simply collecting management fees from existing clients, and focused mostly on finding new clients. We have seen investors make costly mistakes during the bear markets that can have long-lasting impacts on their returns over the long-run.

Active Management

1 . Active Management

“Any intelligent fool can make things bigger, more complex, and more violent. It takes a touch of genius—and a lot of courage—to move in the opposite direction.”

— E. F. Schumacker

A World Class Gameplan

2 . A World Class Gameplan

Our Investment approach at Inside Edge Capital is based on the same approach a world-class ski racer will use. To prepare for the ski race season the racer will ensure they are equipped physically, mentally, and their equipment is the best available and tuned to perfection. When race day comes they have to have 100% confidence that they are fully prepared giving them the best chance of success. Before the race there is an inspection run where the racers slowly side slip down the course building a game plan for the up-coming race. When they are in the starting gate they have to trust that months of off-season preparation, along with the race day inspection of the course yields a battle plan for the upcoming race that lasts 2 minutes or less.

During the race the skier can reach speeds approaching 100 miles an hour. At those speeds the racer has to strongly rely on their game plan as there’s simply too much coming at him to process all variables at those speeds. Most of the racer’s turns are automatic based on the game plan. However, there will be variables that pop up during the race that could not be factored in ahead of time such as snow conditions, ruts, wind, dangerous turns, etc.. The racer has to account and adjust the game plan for those inevitable unforeseen variables to ensure the best chance of victory.

An investment plan is very similar. There are a ton of preparation steps that are taken ahead of time that go into an investment game plan. Many factors including economic and fundamental reports, technical levels, geopolitical events, individual investor risk tolerances, goals, and other various factors need to be accounted for and incorporated into the game plan before dollar one goes into the market. Because when the investment plan is deployed in the market, there will be those inevitable variables that arise that must be quickly accounted for and adapted into your game plan.

To paraphrase Charles Darwin in the Origin of Species, “It is not the most intellectual or strongest of the species that survives, but the species that is best able to adapt and adjust to the changing environment in which it finds itself.

investment models

3 . investment models

“Any intelligent fool can make things bigger, more complex, and more violent. It takes a touch of genius—and a lot of courage—to move in the opposite direction.”

— E. F. Schumacker

Fees – What Are You Really Paying?

4 .Fees – What Are You Really Paying?

“Any intelligent fool can make things bigger, more complex, and more violent. It takes a touch of genius—and a lot of courage—to move in the opposite direction.”

— E. F. Schumacker

“Any intelligent fool can make things bigger, more complex, and more violent. It takes a touch of genius—and a lot of courage—to move in the opposite direction.”

— E. F. Schumacker

We study macroeconomic, geopolitical, fundamental, technical, and market sentiment factors to identify sectors, industries, and individual stocks poised for leadership. We’ll overweight these companies in our portfolios and for the companies setting up to be laggards we’ll underweight, if not exclude them all together.

Three quotes from Warren Buffett speak strongly to this concept:

Buffett Quotes

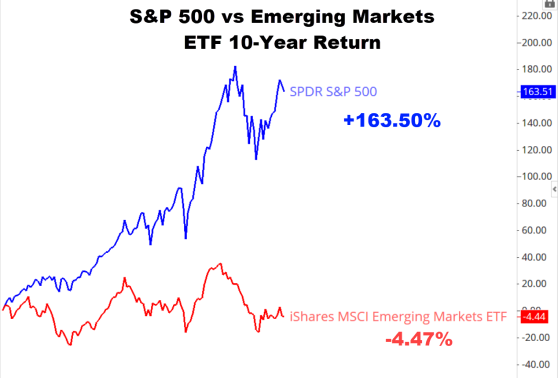

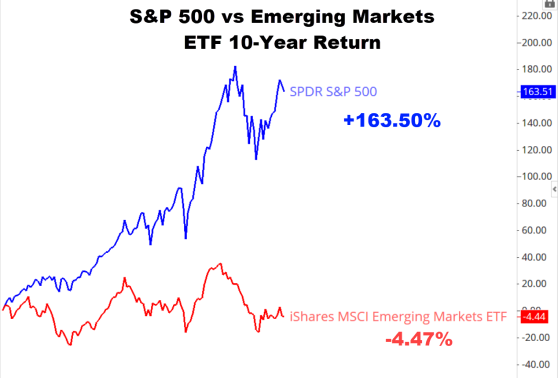

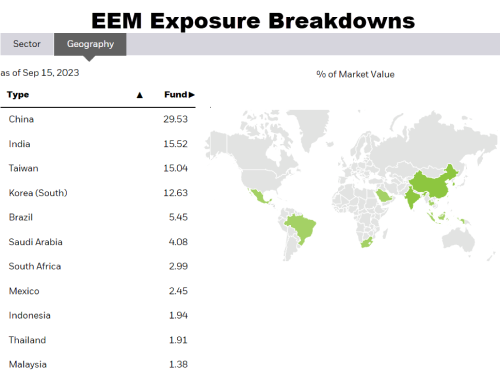

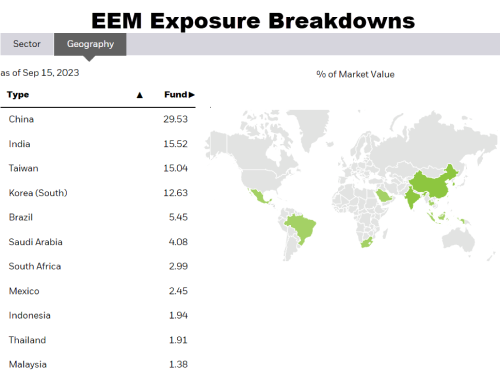

Let’s take a look at the other approach of buying the mutual funds that have the best historical performance. I can tell you this right now; buying historical out-performance is a great way to set yourself up for future underperformance! The masses historically underperform the averages because they’re all doing the same thing; buying what worked last year. The funds and ETF’s that worked in the past quite often will be the laggards of the future. The economy and stock market are far too dynamic to simply buy what’s already been working.

Consider the following statistics for the S&P 500 over the past 50 years:

- 1-Year Total Returns S&P 500 +10.65%

- S&P 500 stocks outperforming: 281

- Annualized 3-Year Total Return S&P 500 +19.45%

- S&P 500 stocks outperforming: 263

- Annualized 5-Year Total Return S&P 500 +10.85%

- S&P 500 stocks outperforming: 206

As you can see above, the longer the investment horizon the fewer stocks outperform the benchmark. You have to know what you own and constantly review your holdings to adapt to the ever-changing economy.

In summary, we have reviewed many account statements of clients whose money managers simply put them in a wide range of mutual funds that are ‘diversified’ and have done well in the past. When speaking to prospects we encourage them to challenge their current wealth manager to produce performance reports and if they actually know what stocks are held within the ‘past-performing’ mutual funds. Rarely do they get a satisfactory response. So in essence you are paying your money manager, who is paying a mutual fund manager (with your money), to buy stocks and he doesn’t know what he’s buying for you? I’m sure you see the issue.

Automation

2 . A World Class Gameplan

During the race the skier can reach speeds approaching 100 miles an hour. At those speeds the racer has to strongly rely on their game plan as there’s simply too much coming at him to process all variables at those speeds. Most of the racer’s turns are automatic based on the game plan. However, there will be variables that pop up during the race that could not be factored in ahead of time such as snow conditions, ruts, wind, dangerous turns, etc.. The racer has to account and adjust the game plan for those inevitable unforeseen variables to ensure the best chance of victory.

An investment plan is very similar. There are a ton of preparation steps that are taken ahead of time that go into an investment game plan. Many factors including economic and fundamental reports, technical levels, geopolitical events, individual investor risk tolerances, goals, and other various factors need to be accounted for and incorporated into the game plan before dollar one goes into the market. Because when the investment plan is deployed in the market, there will be those inevitable variables that arise that must be quickly accounted for and adapted into your game plan.

3 . Investment models

STRATEGY OBJECTIVE

This strategy will hold companies that are on the cutting edge of their industry through innovation, earnings growth, or strong management set to out-perform in the prevailing economic environment. If however, there are current or perceived risks on the horizon ‘Alpha’ will assume a defensive posture through either increased cash holdings or outright hedges such as holdings in inverse ETFs that appreciate when the market declines.

INVESTMENT APPROACH

We utilize a “bottoms-up” process of quantitative, technical, macro, and fundamental analytics to select individual companies with market capitalizations ranging from $1-billion to mega-cap companies.

TACTICAL INVESTING

IEC Alpha holds anywhere from 25-50 individually selected companies from 11 sectors that are showing the most relative sector / industry strength, and increasing revenue, earnings, and market share captre. This strategy is fairly active, tactical, can be defensive and hold cash or even hedges in adverse economic climates with the goal of capital preservation in corrections and bear markets.

STRATEGY OBJECTIVE

This strategy seeks to hold a diversified group of companies across the 11 sectors with a primary emphasis on capital appreciation and a secondary emphasis on a dividend yield that as a whole, exceeds that of the benchmark S&P 500. The strategy attempts to produce an aggregate volatility metric less than that of the S&P 500 to guard against market downturns.

INVESTMENT APPROACH

We utilize a “bottoms-up” process of quantitative, technical, fundamental, and macro analytics to select individual companies with medium-to-mega capitalizations. These companies are industry leaders that project steady revenue growth, strong free cash flow figures, and forward valuation projections below that of the S&P 500. The dividend yield of the portfolio seeks to be higher than the S&P, but not overreaching to bring in higher yields from financially vulnerable companies

TACTICAL INVESTING

Tactical Growth and Income holds anywhere from 35-55 individually selected companies from all 11 sectors that pay a dividend, display rock solid balance sheets, and are industry and sector leaders. Portfolio turnover is less frequent compared to the ‘Alpha’ strategy, but companies will be adjusted throughout the year to reflect the ever-changing business cycle expressed through the broader market’s sector rotation, as well those showing technical relative strength/weakness vs peers.

STRATEGY OBJECTIVE

The primary objective of the fixed income fund is to provide investors with a stable income stream while managing risks associated with interest rate fluctuations, inflation, and credit quality. The fund aims to achieve this by constructing a diversified portfolio of ETFs and mutual funds that hold a mix of corporate, government, and asset-backed/mortgage-backed securities, strategically balanced across different regions and sectors to enhance resilience.

INVESTMENT APPROACH

The fund will employ a dynamic duration management strategy, adjusting the average portfolio duration based on interest rate forecasts and macroeconomic trends. To address interest rate risks, the fund will actively monitor yield curve movements and allocate tactically between short-, intermediate-, and long-term securities. Regional diversification will be achieved by investing across a spectrum of global markets, emphasizing stable economies and yield differentials. In anticipation of inflation, the fund will incorporate inflation-linked securities and sector exposures that historically perform well during inflationary periods. Rigorous credit analysis will guide the selection of corporate bonds, government debt, and mortgage-backed securities to maintain a balance between income generation and credit risk.

TACTICAL INVESTING

IEC Alpha holds anywhere from 25-50 individually selected companies from 11 sectors that are showing the most relative sector / industry strength, and increasing revenue, earnings, and market share captre. This strategy is fairly active, tactical, can be defensive and hold cash or even hedges in adverse economic climates with the goal of capital preservation in corrections and bear markets.

STRATEGY OBJECTIVE

This strategy seeks to achieve rapid capital appreciation through highly active management of equities, derivatives, and ETF’s. This strategy is unconstrained and will engage in frequent trading (several times per week are possible) and will not operate with tax efficiency in mind.

INVESTMENT APPROACH

We utilize a “bottoms-up” process of quantitative, technical, macro, and fundamental analytics to trade markets, companies, or other assets that are poised for rapid appreciation. This strategy is not for the traditional buy and hold investor and will be run by our founder Todd Gordon.

TACTICAL INVESTING

The Active Opps portfolio can hold anywhere from from a few companies to a few dozen and will involve active trading depending on the current market environment. This portfolio can and will change courses when prevailing market conditions require it. Qualified investors only please.

STRATEGY OBJECTIVE

This strategy will hold ETF’s that represent the 11 sectors that comprise the American economy. Depending on the macro environment and stage of the business cycle certain sectors will be leading the averages higher while other sectors will be rotating out of favor and showing underperformance. This strategy seeks to identify the sectors best positioned to benefit from the current business cycle and overweight those holdings relative to the benchmark S&P 500 .

INVESTMENT APPROACH

Adjusted on an as-need basis (approximately 5 times per year) we employ a top down macroeconomic and fundamental assessment of the economy to select sectors that are showing the best earnings growth potential that will likely be rewarded in the future. This strategy seeks to reduce volatility inherent with individual stock portfolios and is geared for the more risk adverse investor.

TACTICAL INVESTING

IEC Alpha holds anywhere from 25-50 individually selected companies from 11 sectors that are showing the most relative sector / industry strength, and increasing revenue, earnings, and market share captre. This strategy is fairly active, tactical, can be defensive and hold cash or even hedges in adverse economic climates with the goal of capital preservation in corrections and bear markets.

STRATEGY OBJECTIVE

This strategy will hold companies that are on the cutting edge of their industry through innovation, earnings growth, or strong management set to out-perform in the prevailing economic environment. If however, there are current or perceived risks on the horizon ‘Alpha’ will assume a defensive posture through either increased cash holdings or outright hedges such as holdings in inverse ETFs that appreciate when the market declines.

INVESTMENT APPROACH

We utilize a “bottoms-up” process of quantitative, technical, macro, and fundamental analytics to select individual companies with market capitalizations ranging from $1-billion to mega-cap companies.

TACTICAL INVESTING

IEC Alpha holds anywhere from 25-50 individually selected companies from 11 sectors that are showing the most relative sector / industry strength, and increasing revenue, earnings, and market share captre. This strategy is fairly active, tactical, can be defensive and hold cash or even hedges in adverse economic climates with the goal of capital preservation in corrections and bear markets.

4 . Fees - What Are You Really Paying?

Here’s a study of fees charged by mutual funds and ETF’s in 2021. The average equity mutual fund expense ratio was 0.47%. The average equity ETF expense ratio is 0.16%. The most famous Nasdaq 100 ETF, the QQQ, has a 0.20% fee. The EFA, one of the most popular international market ETFs that excludes the US and Canada, charges 0.33%.

We manage portfolios of individual equities that are thoroughly screened for technical and fundamental characteristics to even be considered for inclusion in the portfolio. There are no costs to buy, sell, or hold individual stocks. Our typical management fee is 1% or less year per year with no other hidden costs. We do all stock selection and management in house so we know what we own, and are not passing on any hidden costs to you.

Consider the possibility that you are paying a wealth manager 1% per year who places you in a group of ‘diversified’ mutual funds with a total expense of 0.50%. As Buffett says, diversification is protection against ignorance. So you’re paying 1.50% to underperform the averages. We feel investing in the averages is for the ‘average’ investor.

The White House Council of Economic Advisors issued a report that Americans lose more than $17 billion a year from ‘conflicted financial advice’. Many of the major banks, wire houses, broker dealers and even some fiduciaries will earn commissions on investment and insurance products they recommend and sell to you. Other possible hidden or embedded costs are transaction charges, commissions, platform and product fees, revenue share, soft dollar compensation etc. All of these hidden fees may seem insignificant and in the normal course of business, but they dilute your returns and when compounded year after year that adds up! We fight for every last percent return we can earn for our clients, which in time adds up!

Some managers charge flat fees for services. We do not believe in this model. We want to make more money only if YOU make more money. If your portfolio underperforms, we should be penalized. This applies to portfolio management and financial planning. Your wealth manager should be incentivized to grow your account value as much as possible via strategic planning, tax efficiencies, and portfolio growth. If a wealth manager gets paid regardless of what happens, where’s the incentive to continuously strive to do better?