This analysis was written exclusively for CNBC Pro, but we’re making Todd Gordon’s full research available here for all readers.

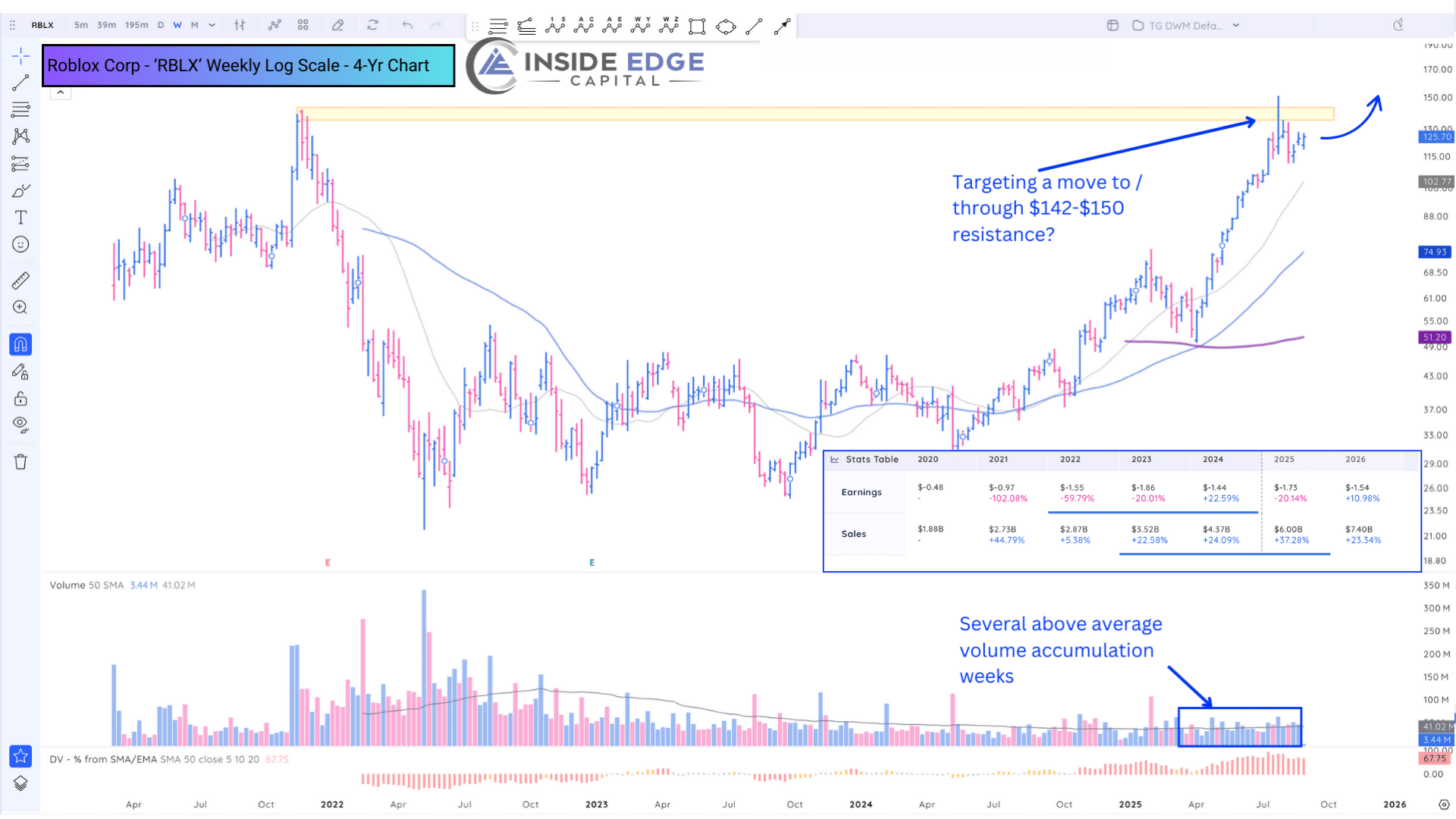

Roblox came to market with a roar in the post-pandemic 2021 environment, only to collapse spectacularly from 2022 through 2024. Now that the stock has re-emerged, the 2023–2025 downturn looks more like a long base-building period that may have set the stage for a breakout through the $142–$150 resistance zone on the way to new all-time highs. During this consolidation, user engagement and bookings growth began re-accelerating, and institutions started accumulating shares again, reflecting confidence in Roblox’s vast community of users, developers, and brand partners. Roblox is positioning itself as a hub for gaming, social networking, and user-generated content.

On a personal note, my 11-year-old twin boys spend more and more time on Roblox with their friends, playing new hits like Grow a Garden and Steal a Brainrot, while also building games of their own. Roblox is working to evolve beyond pure gaming by hosting concerts, fashion shows, and expanding partnerships with brands such as Ralph Lauren, Spotify, Hasbro, Mattel, and Vans.

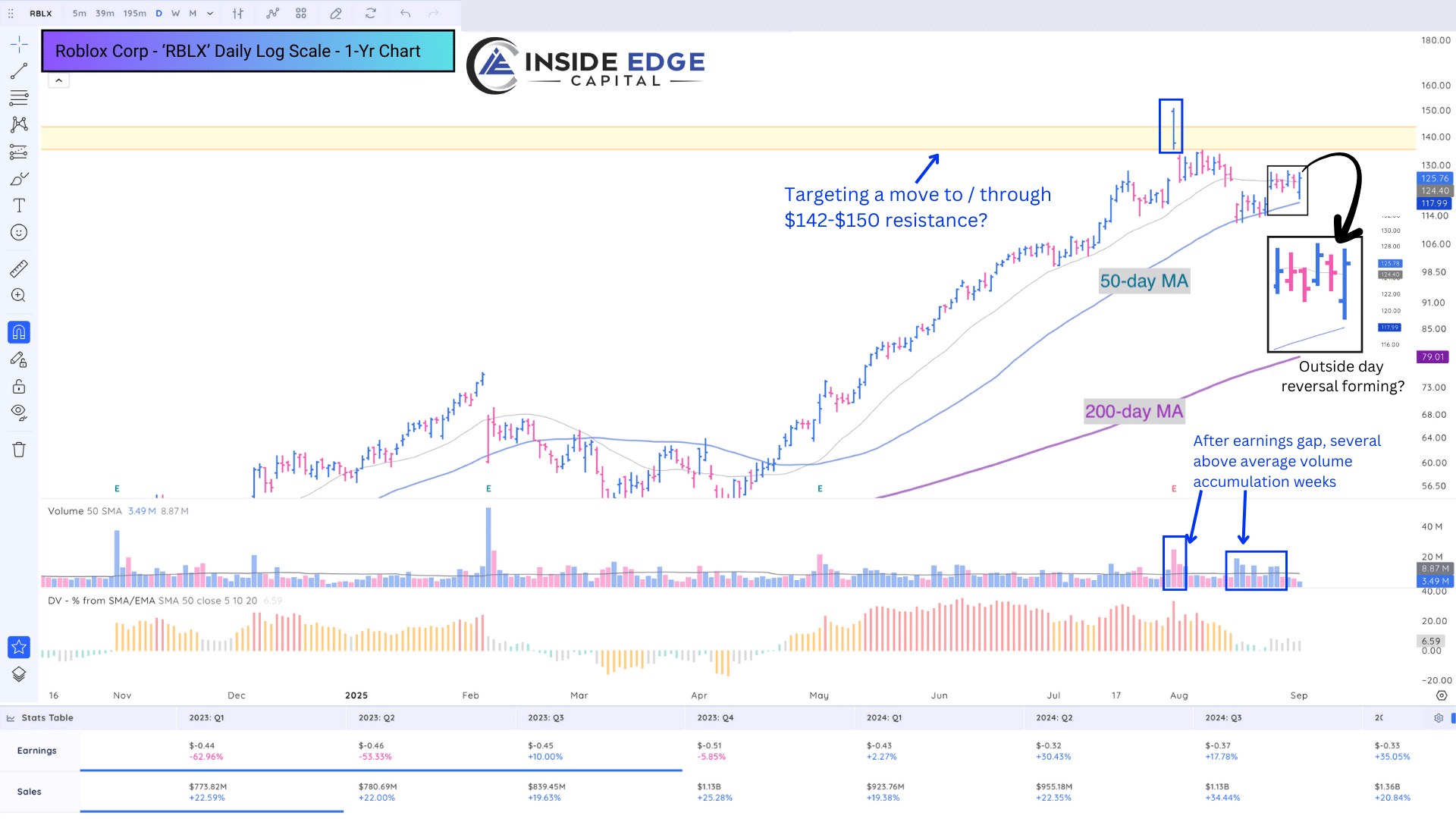

The company is still unprofitable, but as the revenue and EPS inset on the weekly chart shows, sales have been growing more than 20% year-over-year since 2023. Roblox continues to invest heavily in infrastructure and safety, yet maintains a solid balance sheet with $7.85 billion in assets against $7.51 billion in liabilities, leaving about $334 million in shareholder equity. Importantly, free cash flow turned positive in 2024 at $396 million, even though GAAP retained earnings remain negative.

From a technical perspective, the long base carved out in 2023–2024 is giving way to a strong advance, with the stock now threatening to break through the $142–$150 resistance zone. The past 15 weeks have shown several above-average accumulation weeks, a sign that institutions are again building positions.

Looking at the daily chart, Roblox held its 50-day moving average in August and today may be forming an outside-day reversal pattern. This occurs when the stock opens below the prior day’s low and closes above the prior day’s high. Combine that with five above-average volume days over the past two weeks—and today’s reversal coming while the broader market is lower – and RBLX looks poised to make a run at clearing its all-time highs. I also recorded a short video walking through the setup, which you can view here: X/Twitter link.

In our Active Opps portfolio (linked below) we hold a 7.42% allocation. After publishing this article, I’m looking to also add RBLX to our Tactical Alpha Growth (TAG) model at Inside Edge, which is our flagship growth portfolio.

— Todd Gordon, Founder of Inside Edge Capital, LLC

We offer active portfolio management and regular subscriber updates like the idea presented above. Learn more at https://my.insideedgecapital.com/active-opps-landing/