Re-gaining Maximum Potential GDP After A Slowdown

When you drop a rubber ball on the ground, you expect that the harder it falls, the higher the ball will rebound. Similarly, we hope for the same during recessions. When a recession occurs, the deeper the drop-off, the stronger bounce-back we need.

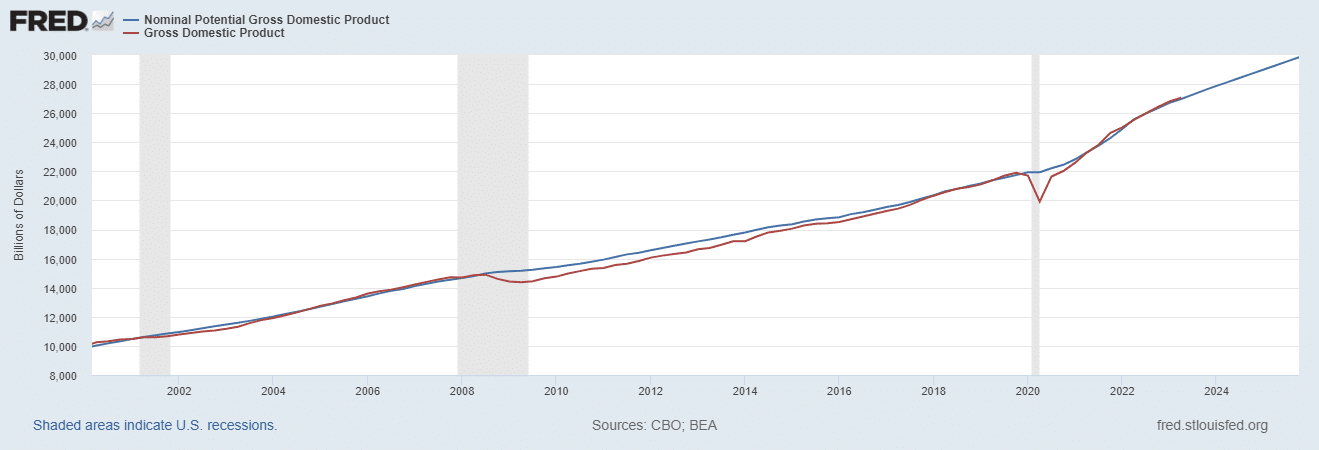

During the 2008 recession, annual GDP growth fell by over 5%. In response, we needed GDP growth above 5% just to return to our Potential GDP over the typical 2-3 year long recovery period. With GDP growth coming in between 2-3%, it took America a decade to catch up to its potential GDP.

We see the definition of an economic recovery as not only reaching our maximum potential GDP, or the highest level of growth that can be sustained over the long-term, but as America getting itself off of the Fed’s medicine that helped us when we needed it. That medicine, when the economy has slowed, is the Federal Reserve’s low interest rate monetary policy.

Low interest rates certainly help Americans during downturns, allowing debtors to re-finance mortgages and other debt. But, at the same time, it hurts savers because they receive less interest. The fact is Americans receive twice as much interest as we pay (if you exclude the government). This means that low interest rates hurt individual Americans twice as much as it helps. Over the short-term, low rates certainly help everyone’s liquidity and spur investment, but over the long-term they can limit growth.

What has this meant to investors? Yields on high-quality bonds dropped significantly. For example, in 2001 it would have taken 14 years for an investment in 10-year Treasury bonds to double. In 2016 it would take 45 years, longer than most investors’ working lives. Meanwhile, stocks and other assets appreciated. However, while 65% of Americans owned stock in 2007, only 52% owned stocks in 2016. During low interest rate periods, you would hope for the opposite to have occurred. That might be explained by the toll that a downturn like that has on investor psychology, but fact remains it’s far from the optimal asset allocation.

During the short-lived 2020 recession which accompanied the onset of the pandemic, the Federal Reserve had a new set of circumstances. Rising inflation prevented the Federal Reserve from using low interest rate policy. So the federal government responded in early-2020 with a massive amount of federal spending and causing GDP to catch up to Potential GDP within two years. Inflation

While these markets were unfavorable to bond holders, what will happen to the bond prices paying over 5% when and if treasury rates drop again, as we saw in 2011, making those 5% bonds very attractive looking to investors searching for yield?

Given the perpetual nature of wealth investing, it is becoming clear that the value of financial planning may be worth as much or more than the value of your investment selection during sluggish economic recoveries like we are currently experiencing.

In other words, the value of advice isn’t just putting you in a diversified portfolio, it’s keeping you there. That means limiting investment costs like panic selling (and the taxes it creates). An investment allocation based on a long-term strategy that’s tailored to the level of investment risk you are comfortable accepting and level of risk you need to meet your goals is not only effective for these market cycles, it provides confidence and peace of mind over the long-term.