Uber’s Technical Breakout and Growth Story

Uber broke above former all-time highs of $64.65 on above average volume and does not seem to be looking back. Some are concerned about the business model, excessive valuation, and other factors but it’s been a core holding in our growth model at Inside Edge Capital and I am looking to increase my position size.

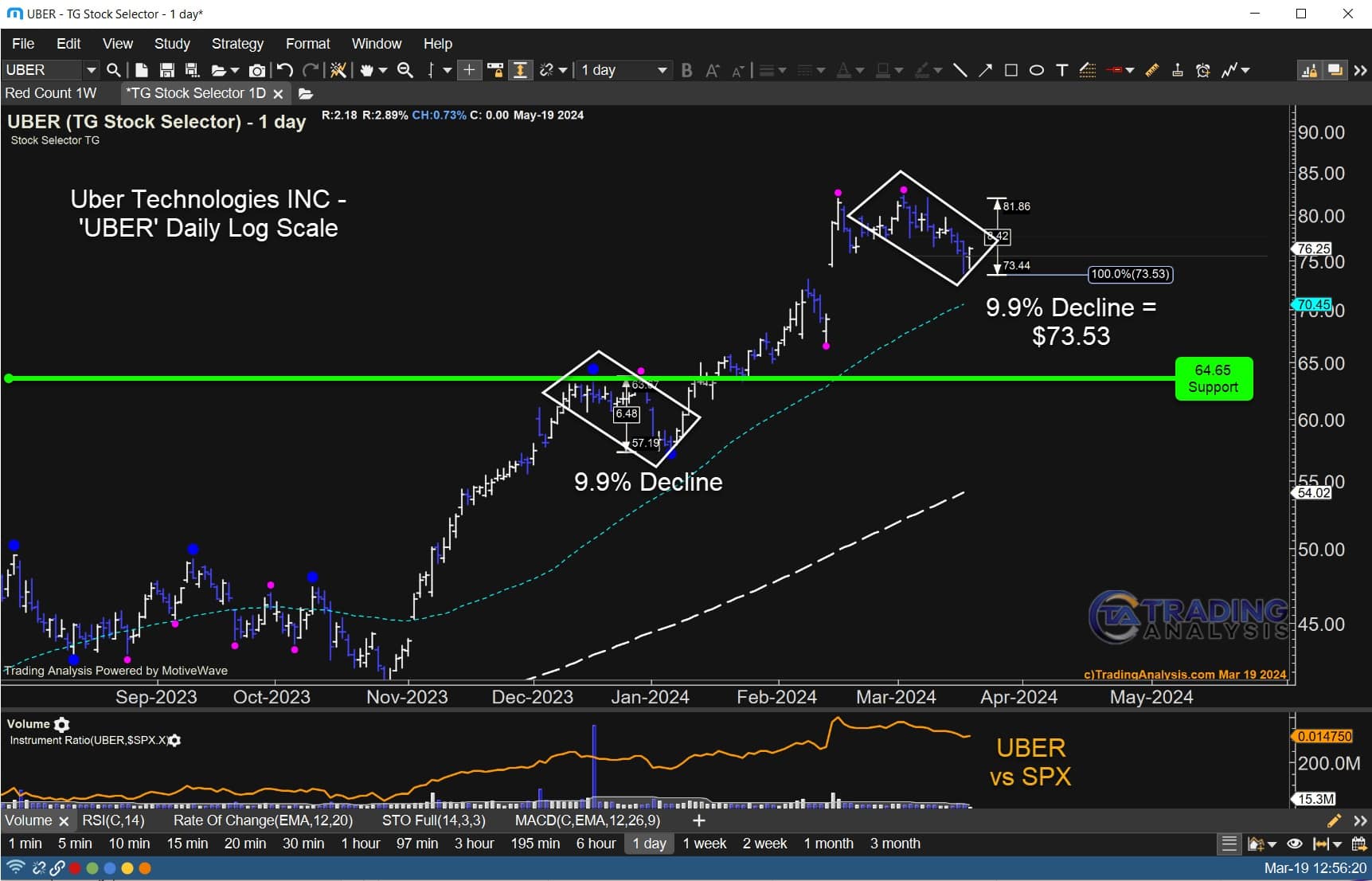

Moving down to the daily chart you’ll notice that in Q4 of ‘23 Uber initially was rejected from the all-time highs of $64.65 and retreated in a 9.9% decline. After regathering itself the stock mounted another attack on the key breakout level, achieved it, and traded as high as $81.86.

Since then another pullback has developed and using a concept called symmetrical price projections we see that another 9.9% decline may have just completed. It’s amazing how often these symmetrical percent moves happen in the charts when you start to look for them. The anticipated support level was $73.53 and we closed Tuesday at $77.05.

We hold a 3% allocation of UBER (established 1% in Feb ‘23, added 1% in Nov ‘23, added 1% in Feb ‘24) and are looking to add another 1-to-2% in the coming week. Once we get through the Fed meeting and, should the market stabilize, we will consider increasing our position.

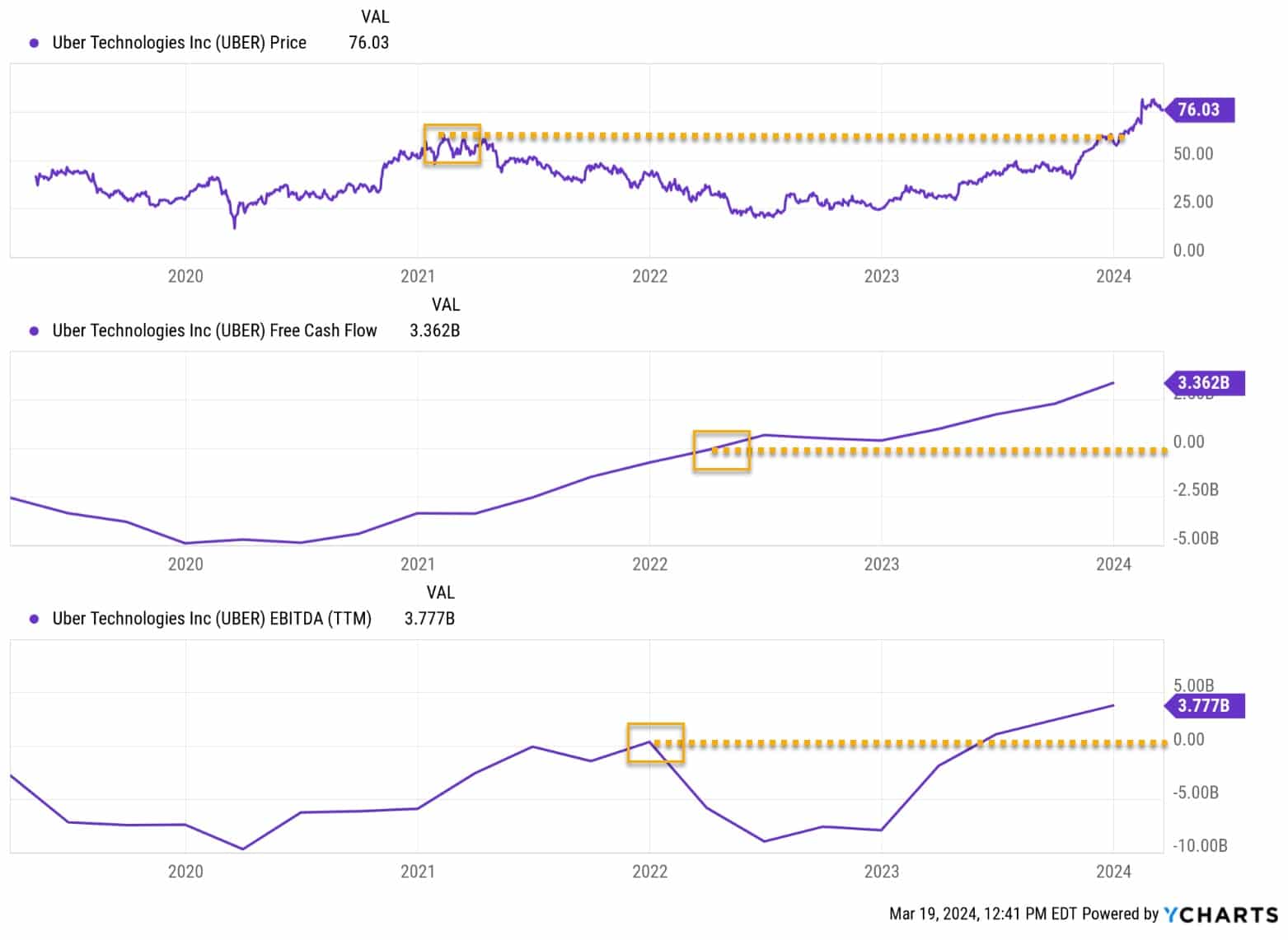

Is the technical breakout corroborated by the fundamental story. I think the answer is yes. Yes to what the markets expect of them and yes to what the company has demonstrated to us.

UBER has come a long way in a short period of time as a publicly traded company. In just 5 years the business model has evolved from just a digital ride hailing company to also offer delivery, freight, and advertising.

Looking backwards, they used to burn a lot of cash! They were burning as much as $5 billion in 2020, $3 billion in 2021, but in 2022 actually went to a positive $2 billion in free cash flow. It approached positive EBITDA in 2022 and achieved it in 2023.

The positive cash flow was a result of fewer ride incentives offered and a smaller marketing spend as the brand recognition began to carry the company. How often do you say “do you want to Lyft to the restaurant”? In fact, in about 10 minutes I’m going to suggest to my wife that we “Uber” to the restaurant to celebrate her birthday!

Looking ahead analysts are calling for 40% EPS growth to $1.22 in earnings in 2024 compared to last year’s earnings. That figure gives us a forward multiple of 63 times earnings. Not cheap!

I think the heavy valuation reflects the company’s vision of autonomous transports for both transportation and delivery. The company has partnered with several autonomous driving companies including Nuro, Waymo, Aptiv, and Hyundai. They are also collaborating with Toyota to move further into autonomous ride sharing and are using Nvidia’s AI technology to power the computing systems in their autonomous driving efforts.