VIX Spikes to Historic Highs Amid Volatile Summer Market

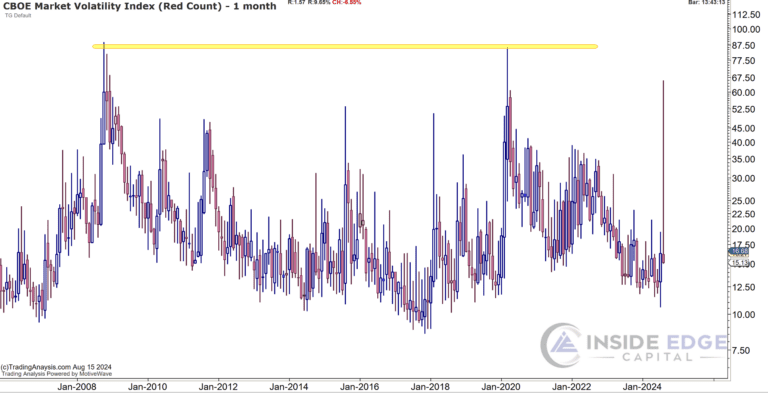

Last Monday, on August 5th, as the stock market selloff intensified and trillions of dollars of market capitalization was erased, the VIX spiked to levels we have only seen a few times in history. On Monday alone, the Magnificent 7 (Mag 7), who had been leading the market upward for most of this rally, lost over $1 trillion in value before the market even opened. The major indices fell just as much, with the Dow losing 1,100 points and the S&P 500 dropping almost 4%.

The VIX, or Volatility Index, is widely known as the “fear gauge” on Wall Street. It measures the implied volatility of S&P 500 options contracts over the next 30 days. As implied volatility in the options market increases, the VIX increases. Anytime there is uncertainty or bad news in the markets, the implied volatility in the options market rises, causing the VIX to spike. Because of this, the VIX is what’s known as a contraction indicator; when the market is gaining momentum, the VIX falls, and when fear hits the market or a downtrend emerges, the VIX rips upward. The VIX also serves as a gauge of how expensive portfolio insurance is; as the VIX rises, the price of options that fund managers use to hedge portfolios increases.

Typically, when the VIX is around 15, investors feel good about their investments, market sentiment is generally positive, and markets tend to move higher. From 15-25, this represents normal market activity, with both bears and bulls present, but the consensus remains relatively bullish. However, once the VIX hits levels above 25 or 30, the market sentiment begins to shift significantly, volatility spikes, and forecasts suggest possible economic downturns.

On Monday, in premarket trading, the VIX spiked to above 65. This level has only been seen two other times this century, both followed by a recession: the 2008 crash and the 2020 COVID crash. Not to draw conclusions, but it doesn’t seem like we are experiencing the same extreme market and economic conditions as in 2008 and 2020.

The 2008 financial crisis was triggered by a collapse of the housing market and failure of major financial institutions, leading to a severe global economic downturn. Similarly, the Covid-19 pandemic in 2020 caused a sharp economic downturn as global lockdowns caused massive job losses and disrupted businesses and supply chains.

While the current spike in VIX is significant, it does not necessarily indicate a repeat of 2008 or 2020. The US economy has recovered from the pandemic and remains robust, and many companies are experiencing strong profit growth. Our founder Todd Gordon was on CNBC last week discussing this development and the so-called ‘yen carry trade’ that accompanied the stock market lower (and VIX higher). He tried to calm the hosts and viewers that this was simply a midsummer swoon likely to do with illiquid market conditions.

Another player in this huge VIX spike could be the seasonality of the market. We are in a summer market, where the moves tend to be outsized, and more traders are away from the desk. When volume is lower, the market tends to make erratic moves with little to no reason. Looking at the seasonality chart of the VIX and S&P 500 we can see the highest average month for the VIX is in August with an average reading of 8.9%

Looking at the S&P 500 seasonality study going back to 1950 August is a very flat month, but September is the weakest of the year. Did we pull that VIX spike and S&P seasonal weakness ahead to the first week in August?

In the coming weeks and months, it will be interesting to see how the VIX behaves. As of this writing on August 15th, the VIX has plummeted back down to a steady 15.4. Given the current environment, Nvidia earnings on August 28th, and the highly anticipated presidential election, it is very possible that the VIX will continue to fluctuate and remain elevated ensuring that we must keep our eye on the ball into year-end.