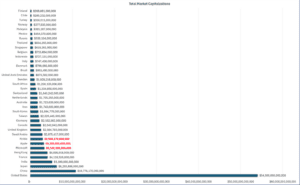

In our short reign as a global superpower, American companies have driven innovation across the globe attracting top talent to work in the U.S., which furthers our competitive advantage. As a result, the sheer size of the U.S. market capitalization relative to other economies is astounding. Specifically, the disparity between some of the top American companies’ market capitalizations and entire countries’ market capitalizations is staggering.

We will let the chart speak for itself, but a few things must be briefly mentioned. The total U.S. market capitalization of $54 trillion compared to other economies really puts into perspective just how much larger the U.S. market is. Well-established countries like the UAE, Denmark, Italy, and many more aren’t even at a market capitalization of $1 trillion, while the US is over 50 times larger.

(Click Image To Enlarge)

Additionally, Nvidia, Apple, and Microsoft each have market capitalizations of around $3 trillion, placing them individually above the market capitalization of all but five countries. Relatively speaking, we have seen all three of these companies gain or lose market value in one day equivalent to the entire GDP of Finland or Turkey.

The size of the U.S. market and specifically American tech companies is something that the U.S. can use to its advantage in the coming years, at the advent of the massive AI push and substantial technological innovation. Nvidia’s massive run has shown us AI is not just a quickly fading market development, and when you look at Nvidia’s earnings projections showing top-line growth of around 100% for consecutive years in the future, we start to see just how much potential there is.

Looking at the chart again, we can see that if there is substantial growth in the technology world, it will most likely stem from the U.S. as all of the world’s big tech companies are here. Apple, Microsoft, and Nvidia alone combine for a market capitalization of roughly $9.5 trillion, and the only country (besides the U.S.) with a market capitalization of $9.5 trillion and above is China sitting just above $10 trillion. With the AI boom progressing, it is very probable that the U.S. will continue to drive this innovation. This will result in huge flows of capital to the U.S. market and greater returns on domestic investments.

Another development in the world economy that the U.S. is positioned well to benefit from is the global labor shortage. It is estimated that by the end of this decade, the world will be short 80 million workers across various industries. In terms of pay, this is just about three trillion dollars in unpaid salaries. With the U.S.’s massive market and tech companies driving global innovation, the U.S. is positioned to fulfill this labor shortage not with workers, but with digital solutions. The three trillion in unpaid wages will mean that much more revenue in the future for tech companies, driving profitability even further.

When looking forward to the developments of the coming years, it is apparent to us that the U.S. has positioned itself very well to thrive. AI innovation is already driven by American companies, and the U.S. has all the tools to fulfill the coming labor shortage. Because of its massive market capitalization, technological changes in the next few years will all flow through the U.S., and position the U.S. market perfectly to thrive.

Trevor Ruberti

Intern, BU ’27